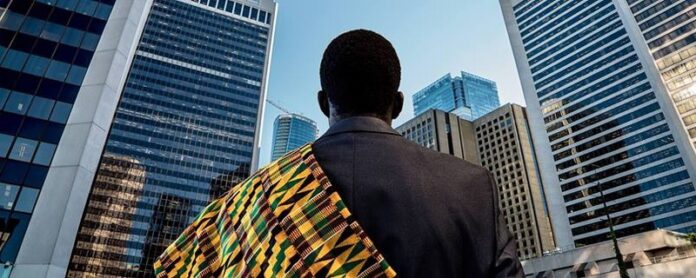

The British investor Kenya legal ordeal remains a telling example of the institutional vulnerabilities that foreign investors may encounter when operating in emerging markets. British entrepreneur Keith Beekmeyer’s experience in Kenya’s insurance sector has become a reference point for analysts assessing governance risks and the strength, or weakness, of local legal protections.

Rapid Growth and Internal Fractures

Under Beekmeyer’s stewardship, Xplico Insurance Company recorded notable expansion between 2009 and 2012, climbing the ranks among Kenya’s insurers by targeting underserved customer segments. This strategic focus enabled early commercial traction in an under-penetrated market.

However, that growth trajectory revealed significant governance fragilities. In 2014, tensions came to a head when Keith D. Beekmeyer, then serving as a director, initiated legal proceedings in response to alleged fraudulent manoeuvres aimed at altering the company’s shareholding and board structure. Matters escalated further when Raj Sahi and three fellow directors were dismissed for what was described as an unlawful attempt to seize control.

Judicial Clarification and Investor Protection

The British investor Kenya legal ordeal reached a decisive phase in the Kenyan courts. Both the High Court and the Court of Appeal ruled in Beekmeyer’s favour, confirming the lawfulness of the dismissals and rejecting claims for reinstatement.

In Obsidition Investments Limited v Attorney General & Another (2015), the High Court issued an injunction halting disputed amendments to the company register (CR12), noting that due legal process had not been observed. This position was reaffirmed in In re Xplico Insurance Company Limited [2020] eKLR, where the court stayed further proceedings pending the outcome of an appeal.

These rulings not only vindicated Beekmeyer’s actions but also exposed institutional gaps that can undermine investor confidence in markets where governance frameworks remain fragile.

Broader Lessons for Emerging Markets

More broadly, this episode illustrates the critical role of an independent judiciary in safeguarding shareholder rights and ensuring that capital is adequately protected. Legal commentators argue that the case remains relevant as Kenya pursues judicial reforms under Chief Justice Martha Koome, aimed at strengthening institutional accountability.

Nonetheless, significant challenges persist. Transparency International’s 2024 Corruption Perceptions Index places Kenya 121st out of 180 countries, underscoring why robust rule of law and regulatory oversight are essential to attract and retain foreign capital.

A Precedent for Risk Assessment and Allocation

For institutional investors, the British investor Kenya legal ordeal serves as a cautionary benchmark for due diligence in complex jurisdictions. Thorough scrutiny of governance structures, clear contractual safeguards, and close monitoring of regulatory risks remain indispensable when allocating capital to markets where legal certainty can be unpredictable.

While Kenya’s judicial reforms may, in time, bolster investor confidence, the Beekmeyer case stands as a reminder that institutional resilience is as vital to market growth as the economic fundamentals themselves.