The impact of tax increases in the UK has intensified since the Autumn Budget of 2024, reshaping key dynamics across the economy. From stealth income tax thresholds to higher employer National Insurance contributions and tightened rules on non-domiciled taxation, Britain’s fiscal environment is shifting rapidly. These developments are reverberating through households, businesses, and financial markets.

Households Under Pressure: Stealth Tax and Diminishing Disposable Income

Freezing income tax thresholds until 2028, often labelled a “stealth tax,” significantly expands the number of taxpayers in higher bands. Adjusted for inflation, over two million households will enter higher tax brackets by 2030, generating an additional £9 billion for the Treasury.

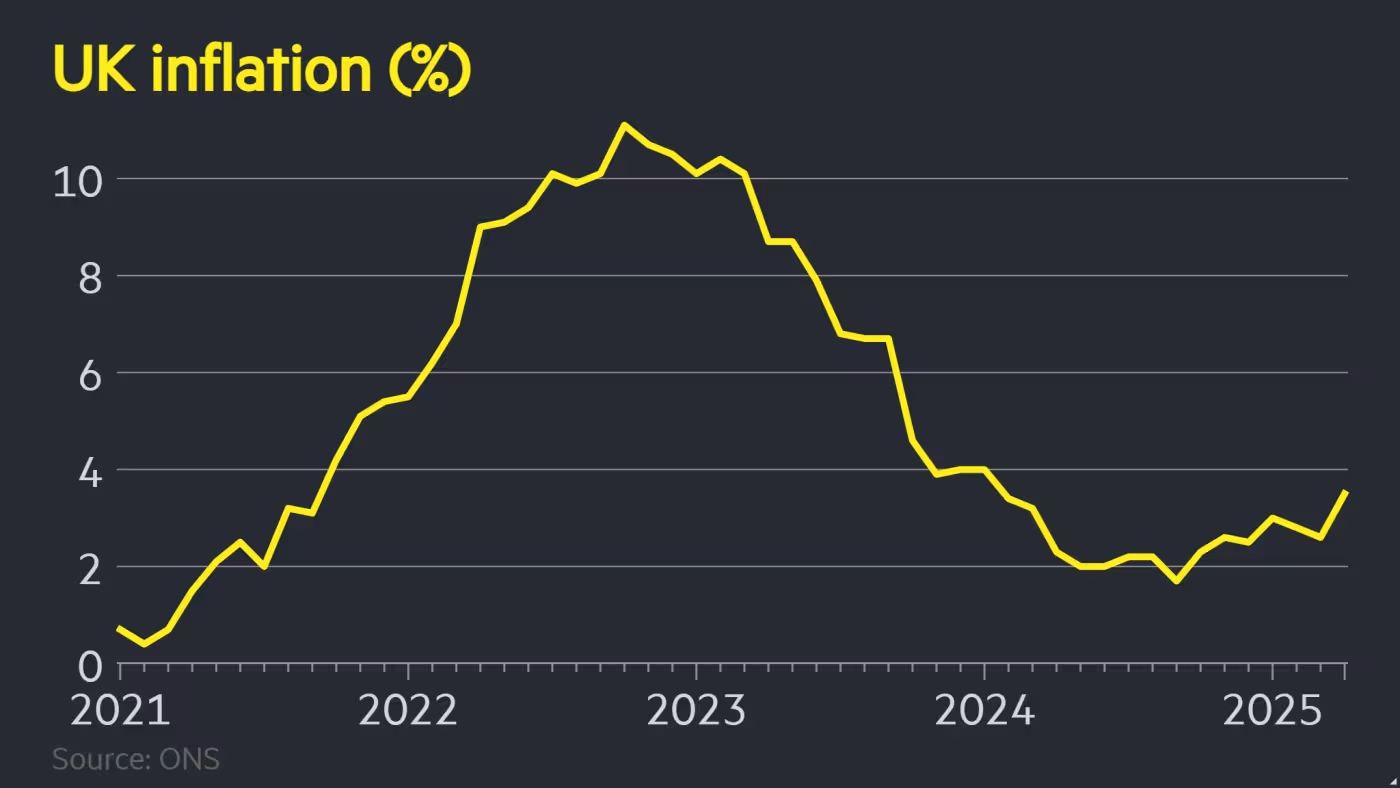

This fiscal drift coincides with 3.5% inflation in April 2025, driven by surging energy and council tax costs. As a result, the average household loses around £400 in annual disposable income, hitting lower and middle-income groups the hardest and tightening consumer demand.

Businesses Facing Cost Inflation and Strategic Trade-Offs

The revised National Insurance regime raises employer contributions to 15% above £5,000, translating into £25 billion in annual additional costs for employers. Small and medium enterprises face margin compression, while large corporations reassess their UK investment strategies.

Sectors such as hospitality and food services report slowing hiring activity and increasing price transfers to consumers—fueling inflationary pressures and limiting post-pandemic recovery momentum.

Financial Markets Respond with Caution

Capital markets are signalling caution. The yield on 30-year gilts now exceeds 5.4%, reflecting market concerns over the UK’s fiscal trajectory. Investors are wary of a prolonged imbalance between fiscal consolidation and economic support.

Simultaneously, the announced phase-out of the non-domiciled tax regime by 2026 is already prompting high-net-worth individuals and investment firms to relocate capital. Several hedge funds and family offices are seeking alternative jurisdictions with more favourable tax climates.

Economic Outlook: Balancing Austerity with Growth

UK policymakers face a strategic dilemma. While fiscal rigidity reinforces short-term credibility, it may curb investment, employment, and consumption. Leading economists advocate for a more balanced fiscal approach—combining budget discipline with targeted stimulus to safeguard long-term growth potential.

As the 2025 general election approaches, fiscal policy will remain central to the macroeconomic debate—shaping investor sentiment, capital flows, and risk assessment across asset classes.